IMG 20240703 WA0008

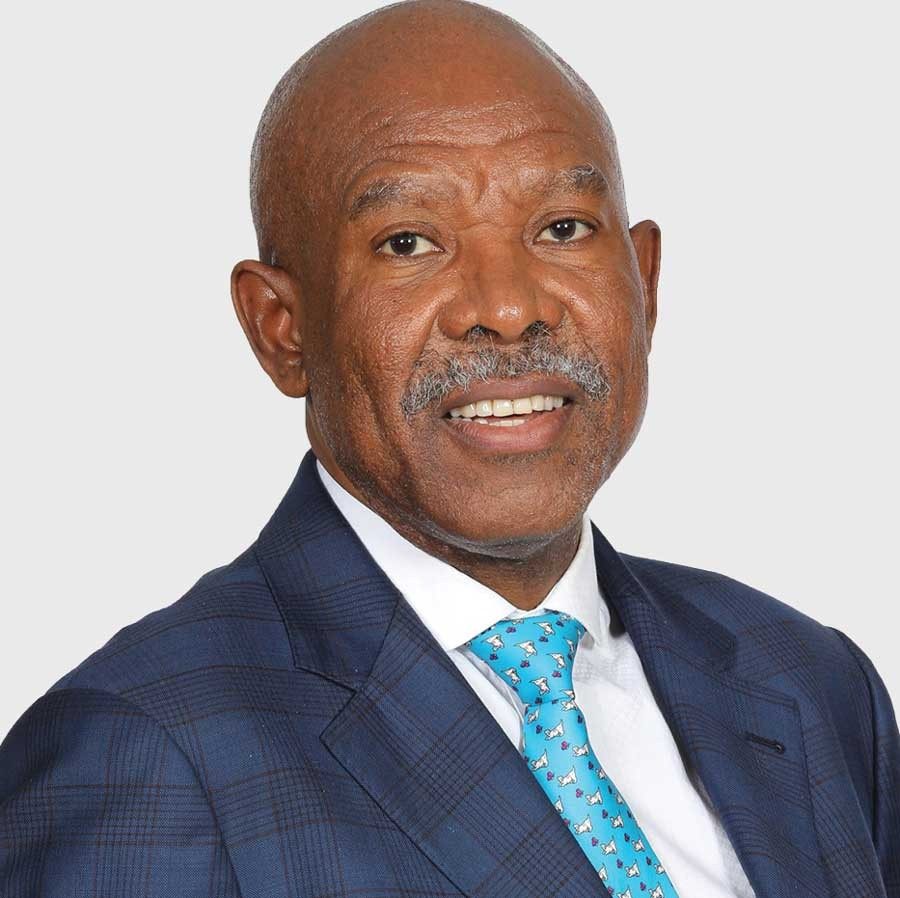

Picture Courtesy: (Reserve Bank) SARB governor, Lesetja Kganyago, is comforted by the reappointment of Enoch Godongwana as Finance Minister.

(The Post News)- Enoch Godongwana’s reappointment to cabinet as Finance Minister has been welcomed by the Governor of the South African Reserve Bank (SARB) Lesetja Kganyago.

Godongwana was reappointed to the finance portfolio by President Cyril Ramaphosa on Sunday, during his cabinet announcement.

In an interview with Bloomberg TV on Tuesday at the European Central Bank Forum in Portugal, Kganyago stated that it gives them comfort that they still have the same finance minister they have been talking to, a minister who has been providing them with leadership and guidance on macroeconomic policy.

The establishment of what is being called the government of national unity has eased the worries of investors who were unsure about what type of a coalition would emerge after the elections in May, he continued.

For the first time in South Africa, the party that governed the Republic since 1994 after the end of apartheid, the ANC did not obtain an outright majority in the May 29 elections, causing it to lose its majority seats in parliament.

That led to the formation of a coalition government with the country’s largest opposition party, the DA, along with other smaller parties.

Lesetja Kganyago added that while there were concerns in the markets regarding which type of a coalition arrangement would arise, owing to the makeup of the so-called government of national unity, there was positivity.

Opinion polls at the beginning of the year had been forecasting the South African elections being tightly contested.

With uncertainty in the air, since the beginning of the year, throughout the three monetary policy committee meetings the South African Reserve Bank has held, the Bank chose to maintain interest rates at 8.25%.

The bank often uses interest rates to control inflation, at the current moment inflation is above the reserve bank’s target range, which is a midpoint between 3% and 6%, that is 4.5%. Currently, inflation is at 5.2% according to Trading Economics.

Kganyago also noted that, as risks continue to be present regarding the reserve bank’s forecasts on price stability, factoring in the effects of El Nino on food and oil prices, as well as geopolitics, SARB is confident in its prediction that inflation will return to their targeted midpoint of 4.5% in 2025.