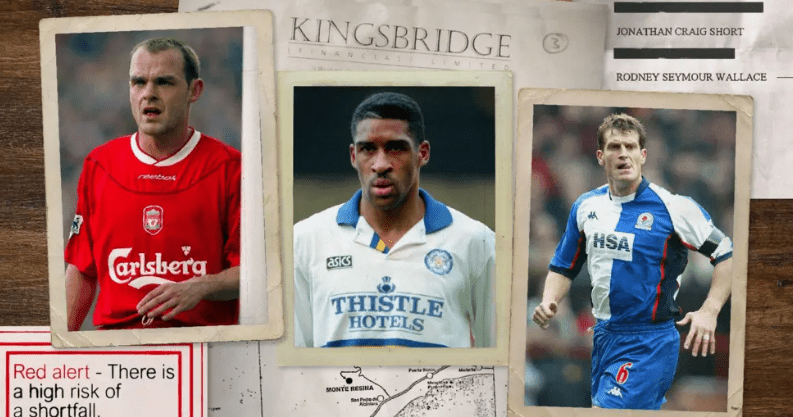

Danny Murphy, Brian Deane and Craig, Former footballers who lost their Millions on investments. Image-Getty Images.

Former Football Stars Accuse Financial Advisers of Costing Them Millions.

(The Post News)- Former football stars claims they lost tens of millions of pounds due to poor advice and mismanagement by the Kingsbridge Asset Management.

Footballers including Danny Murphy, Michael Thomas, and Rod Wallace formed the V11 campaign group—representing 11 players who invested with Kingsbridge in the 1990s and 2000s. Murphy, now a Match of the Day pundit and former England midfielder, estimates his personal losses at around £5 million, describing the experience as “financial abuse.”

While Murphy and others say Kingsbridge failed to act in their best interest, the firm’s founders, David McKee and Kevin McMenamin, deny any wrongdoing. “We always advised in good faith and clearly outlined the risks and opportunities before and after any investment,” they told the BBC.

The financial fallout appears far wider than the V11 group alone. Up to 200 footballers may have been affected, with some losing their homes or even facing bankruptcy. Despite this, many are now being pursued for unpaid taxes, even after the City of London Police informed them they had been victims of financial crime.

Former striker Brian Deane, who famously scored the Premier League’s first-ever goal in 1992, also joined the V11 campaign. He described how the influx of money into football during that era led many players to seek trusted financial guidance.

“We should have felt protected,” said Deane. “Kingsbridge looked like the right choice. Everyone just wanted someone to handle our money after retirement.”

Kingsbridge Asset Management, founded in Nottingham by McKee and McMenamin in the same year the Premier League launched, quickly built a client base of over 360 footballers. According to Deane, the company’s influence spread rapidly through dressing rooms via word of mouth.

Former Aston Villa and Celtic striker Tommy Johnson revealed that his agent introduced him to Kingsbridge. Over time, he grew close to the firm’s founders, even inviting them to his wedding and vacationing with them. “They weren’t just financial advisers,” Johnson said. “They were friends. But they ruined our lives.”

Kingsbridge gained credibility through its partnership with the League Managers Association (LMA). The firm ran the LMA’s website and received an endorsement from then-chairman Howard Wilkinson, who had managed Leeds United and England.

Rod Wallace, who became Leeds’ record signing in 1991, said the LMA connection reassured him and his wife during a critical time when they were planning to start a family. “It just felt natural to go with them,” he said. But things began to unravel in 2008, when Wallace noticed irregularities in his investments.

At one time, his net worth stood at £1.9 million, but by February 2024, he had been declared bankrupt. “We live in Surrey,” Wallace said. “It’s been a good place to live, but we have to leave now because of an eviction notice. There’s nothing left in the bank. We don’t have anywhere to go.” Wallace also held shares in Kingsbridge, which he said were his first investment in any company.

Howard Wilkinson also owned Kingsbridge shares. A letter seen by the BBC reveals that the firm paid Wilkinson £2,033 per month for four years, citing his continued shareholding as serving “the best interest of the LMA’s business partnership with Kingsbridge,” even as the shares lost value.

The LMA distanced itself from the deal, stating: “Any arrangement between David McKee and Howard Wilkinson was a personal agreement. The LMA was not involved.”

Former Premier League Stars Investments.

In 1997, the UK Treasury introduced tax relief on investments in domestic film productions in an effort to support and grow the national film industry. However, according to investment fraud lawyer Ben Rees, the government failed to anticipate how these tax incentives would be exploited. “They never expected the tax relief to be turned into a financial product,” he said.

Kingsbridge Asset Management advised its clients—many of them professional footballers—to invest in film financing schemes, often using a combination of their own money and bank loans.

Rod Wallace, one of the affected players, invested over £2 million into such schemes.

Following that, Kingsbridge encouraged players to purchase property, promising a 40% tax rebate that wouldn’t need to be repaid for 15 years. Four members of the V11 group purchased apartments worth €618,500 each in a Spanish development called Monte Resina.

“They pitched it to me and the other lads as an exclusive opportunity we couldn’t afford to miss,” said Brian Deane.

However, documents reviewed by the BBC reveal that David McKee and Kevin McMenamin, the founders of Kingsbridge originally owned those same apartments. They also directed a property management company, operated by McKee’s wife, to oversee the rentals.

“McKee and McMenamin set the inflated prices themselves, then advised their clients to buy at those rates. An independent valuation later confirmed the prices were significantly over market value.”