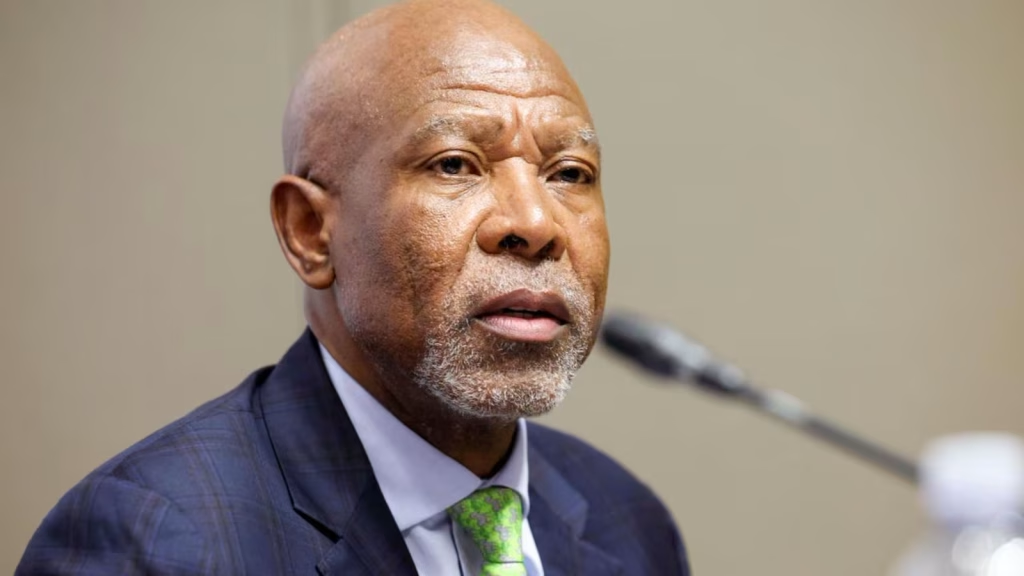

Finance Minister Enoch Godongwana. Image: Independent Newspapers.

(The Post News)– For the first time in almost 25 years, Finance Minister Enoch Godongwana has announced a new inflation target of 3%. This replaces the earlier target range of 3% to 6%, which had been in place since 2000.

The move was unveiled during the Medium-Term Budget Policy Statement (MTBPS) in parliament on Wednesday afternoon.

It is aimed at stabilizing prices, boosting investor confidence, and aligning the country with global best practices.

A Shift in Inflation Policy

The decision was made after months of lobbying by South African Reserve Bank (SARB) Governor Lesetja Kganyago. He argued that the old range was too wide and undermined competitiveness.

Kganyago also noted that the 1 percentage point band allows flexibility to absorb unexpected inflation shocks.

By 2021, it argued that even 4.5% was too high for an emerging market. Over the next four years, the Bank intensified its advocacy as inflation trended closer to 3%.

In July, Kganyago surprised markets by anchoring policy at 3% without Treasury’s approval, sparking tension with Godongwana. The dispute unsettled investors, though expectations soon adjusted, with five-year inflation forecasts dropping to a record low of 4.2%.

By September, the Reserve Bank and Treasury issued a joint statement, easing concerns and confirming cooperation on the new target.

According to Godongwana, this aligns with South Africa’s long-standing flexible approach to inflation targeting, which looks beyond short-term fluctuations.

The Reserve Bank will work continuously to meet the target and clearly report any deviations. The new target replaces the earlier 3%–6% range and will be phased in over the next two years.

Godongwana added that a lower target will gradually reduce inflation expectations and actual inflation.

Economic Impact and Parliament Reaction

A lower inflation target is expected to reduce interest rates over time, making borrowing cheaper for households and businesses. This could stimulate investment, increase consumer spending power, and support economic growth.

For ordinary South Africans, the benefits may be felt in lower food and fuel prices. They may also experience more predictable costs of living. The National Treasury noted that the revised target would particularly benefit poorer households, who are most vulnerable to inflationary shocks.

Opposition parties offered a mixed response to the medium-term budget policy statement (MTBPS).

They described it as a step toward economic recovery. However, they criticised its limited focus on unemployment.

ACDP chief whip Steve Swart said the country was “moving in the right direction.” However, concerns remained about sluggish growth. There were also worries about high debt service costs.

Meanwhile Rise Mzansi leader Songezo Zibi acknowledged signs of fiscal improvement but warned that the projected 1.2% growth rate was far too low to generate jobs for millions of unemployed South Africans.

He argued that growth of between 4% and 6% was necessary for sustainable employment. DA finance spokesperson Mark Burke praised the budget for delivering a smaller deficit than expected. It has also stabilized the debt-to-GDP ratio, which is forecast to decline for the first time since 2008.

UDM chief whip Nqabayomzi Kwankwa pointed to early signs of economic growth. EFF leader Julius Malema rejected the MTBPS outright. This underscores the divisions among opposition parties over the government’s economic strategy.